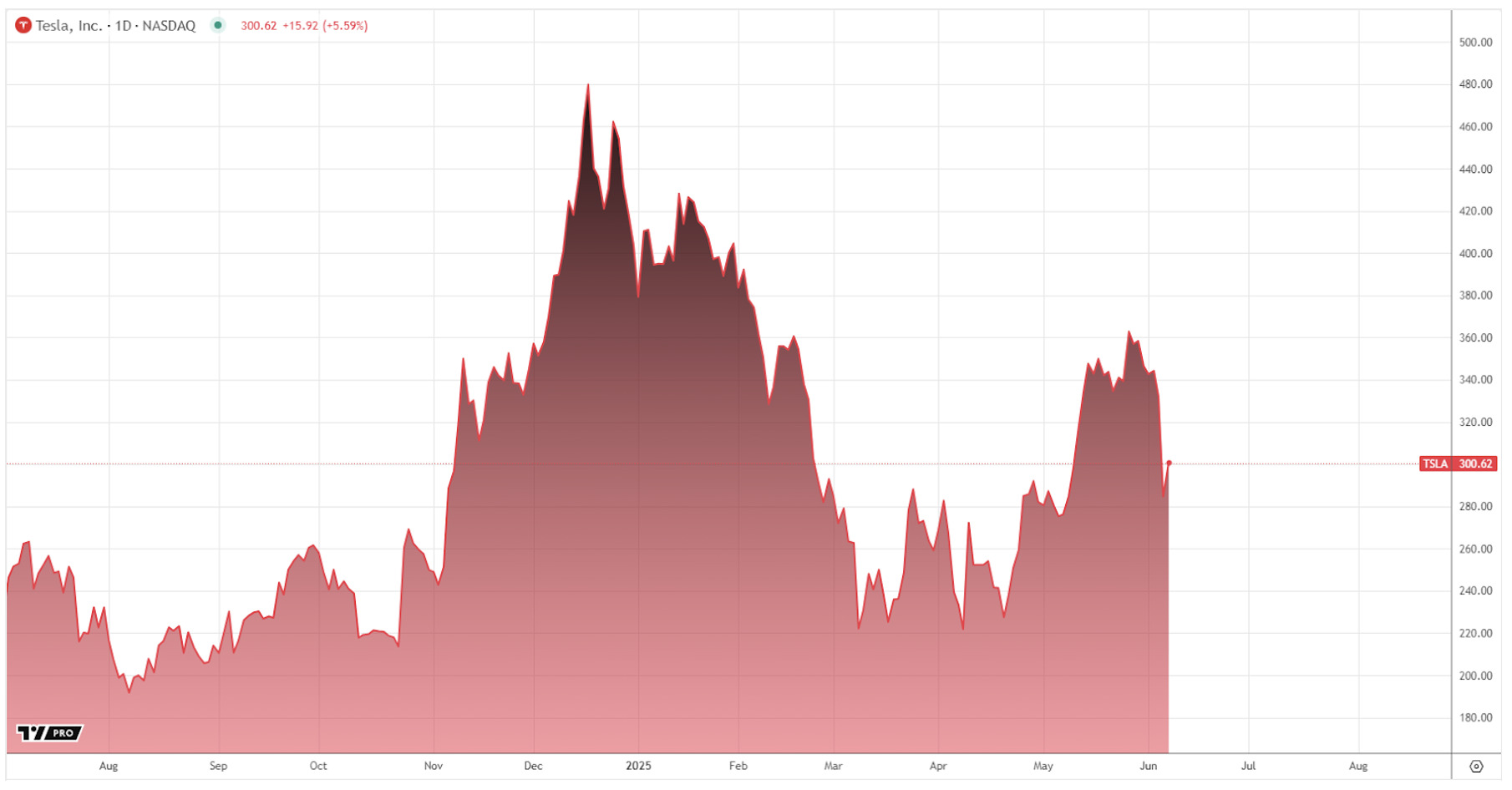

The sudden escalation in tensions between Donald Trump and Elon Musk led to a powerful market shock: Tesla stocks collapsed by 14% in one day, the most significant drop in the company’s history. The electric car manufacturer’s capitalization decreased by $152 billion, falling below the psychologically important mark of $1 trillion. Major players were ready to short ES and NASDAQ 100 futures, but it paid off.

The reason for the collapse was the Trump administration’s decision to cancel the subsidy program for purchases of Tesla electric vehicles. This program previously allowed buyers to receive tax breaks of up to $7,500 per car. This decision directly hit the demand for the company’s products, as subsidies were a key incentive for many buyers.

This is not the first time that Musk’s political decisions have affected Tesla. In 2019, Trump cut electric vehicle subsidies, leading to a 7% stock drop. However, the current drop turned out to be twice as strong, as investors fear the long-term consequences of losing government support.

In addition, in 2022, after the scandal with the purchase of Twitter (now X), Tesla shares plummeted 65% in a year due to concerns that Musk was distracted from managing the company. The situation is repeating itself: the conflict with the White House adds political risks that the market does not like.

The paradox of May: Stocks rise with falling sales

Interestingly, just a few weeks earlier, in May 2024, Tesla shares rose by 22%, despite the continued decline in sales worldwide. Analysts attributed this growth to:

- Speculation about new models (for example, a budget electric car for $25,000).

- Hopes for the resumption of cooperation with China.

- The overall growth of the technology sector amid lower Fed rates.

- The activity of speculators and automated trading systems.

However, since the beginning of June, stocks have begun to fall sharply:

- 18% in a week, after Musk publicly opposed the new US federal budget.

- 30% since the beginning of the year, due to increased competition (especially from Chinese BYD and NIO).

Double blow: cancellation of benefits for solar panels and a new tax on electric vehicles

In addition to abolishing subsidies for electric cars, the new budget eliminated benefits for owners of solar panels produced by Tesla through the SolarCity division. This could hit the demand for green energy, which has been one of the company’s key areas.

However, the most unexpected blow is the proposal to introduce an annual fee of $250 for electric vehicle owners. The authorities explain this by referencing the loss of revenue from gasoline excise taxes, but for Tesla, this means additional barriers for buyers.

Elon Musk lost more than $30 billion due to the fall in Tesla shares, which directly affects his ability to finance SpaceX, Neuralink, and X. If the conflict with Trump is not resolved, the company may face:

- Further outflow of investors.

- Lower margins due to the need to lower prices.

- Increased pressure from regulators.

So far, the situation resembles 2022, when Tesla was experiencing a crisis due to overvalued growth projections. However, political risks have been added to the market risks, making the company’s future even more uncertain.